Understanding Interchange Fees in Cloud Payment Processing

In today’s digital age, cloud payment processing has become an integral part of businesses worldwide. It allows merchants to accept payments from customers seamlessly and securely, without the need for physical payment terminals. However, behind the scenes of this convenient payment method lies a complex system of fees and charges, one of which is interchange fees.

In this article, we will delve into the world of interchange fees in cloud payment processing, exploring what they are, how they work, their role in the process, factors affecting them, different types, benefits and drawbacks, calculation methods, strategies to minimize them, and address frequently asked questions.

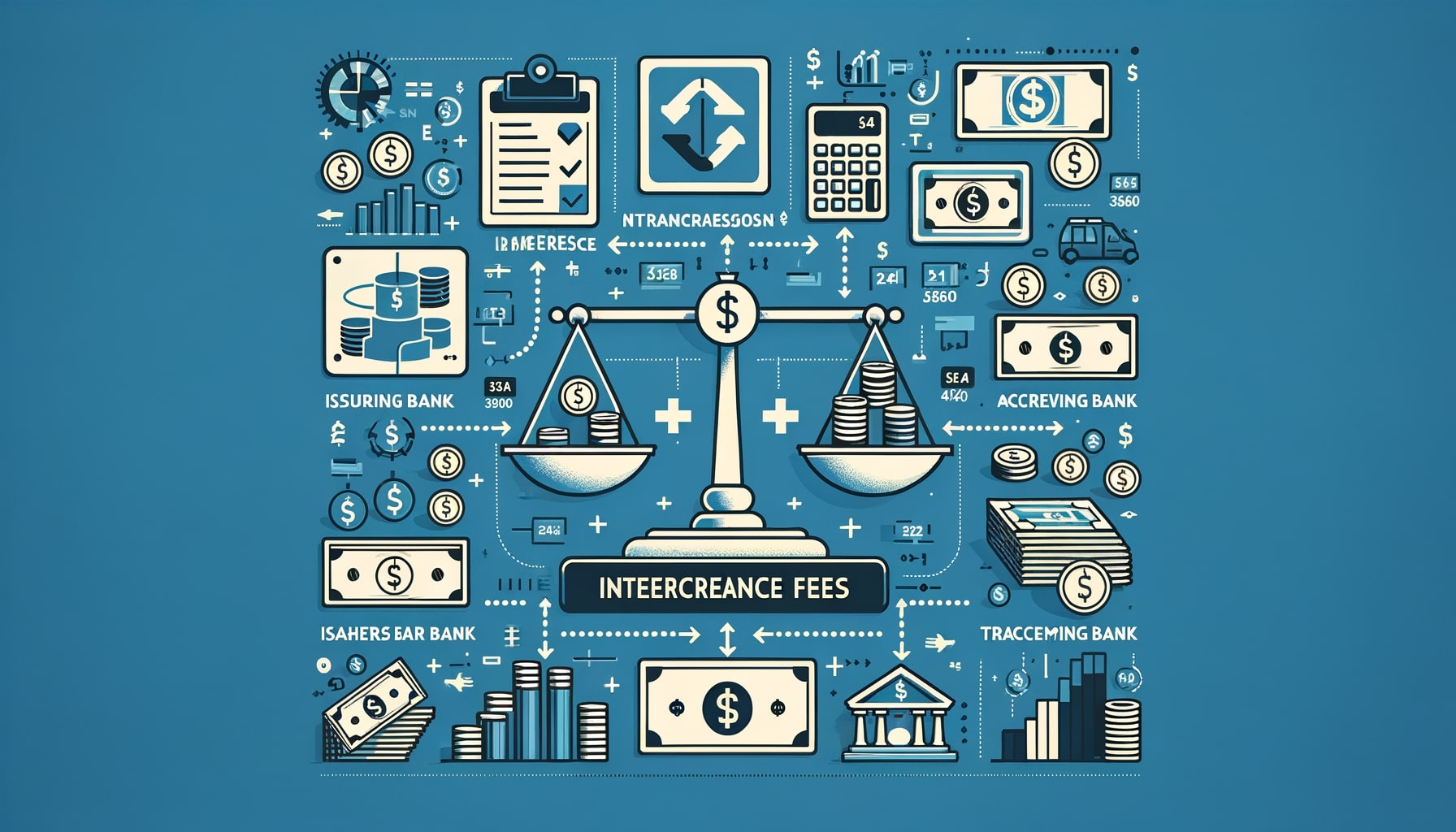

What are Interchange Fees and How Do They Work?

Interchange fees are charges imposed by payment card networks, such as Visa, Mastercard, and American Express, on merchants for processing credit and debit card transactions. These fees are paid by the acquiring bank, which is the financial institution that processes the payment on behalf of the merchant, to the issuing bank, which is the bank that issued the card to the customer. The interchange fees are a percentage of the transaction value and are set by the payment card networks.

The purpose of interchange fees is to cover the costs associated with processing card transactions, including fraud prevention, authorization, clearing, and settlement. They also serve as a revenue stream for the payment card networks and incentivize issuing banks to provide cards to consumers. The fees are typically divided between the payment card networks and the issuing banks, with the networks receiving a larger share.

The Role of Interchange Fees in Cloud Payment Processing

Interchange fees play a crucial role in cloud payment processing as they determine the cost that merchants incur for accepting card payments. These fees can significantly impact a merchant’s profitability, especially for businesses with high transaction volumes or low-profit margins. Understanding the role of interchange fees is essential for merchants to make informed decisions about their payment processing strategies.

Firstly, interchange fees contribute to the overall cost structure of accepting card payments. Merchants must factor in these fees when setting their prices and determining their profit margins. Higher interchange fees can eat into a merchant’s profits, while lower fees can provide a competitive advantage.

Secondly, interchange fees influence the choice of payment card networks that merchants accept. Different networks have varying fee structures, and merchants must evaluate the costs and benefits of accepting cards from each network. Some networks may offer lower interchange fees but have lower acceptance rates or limited customer reach, while others may have higher fees but provide broader acceptance and customer base.

Factors Affecting Interchange Fees in Cloud Payment Processing

Several factors influence the interchange fees charged in cloud payment processing. Understanding these factors can help merchants navigate the complex fee structure and optimize their payment processing costs.

- Card Type: Different types of cards, such as credit, debit, rewards, and corporate cards, have varying interchange fee rates. Credit cards typically have higher fees due to the additional benefits and rewards they offer to cardholders.

- Transaction Type: The nature of the transaction, whether it is a card-present or card-not-present transaction, affects the interchange fees. Card-present transactions, where the card is physically present during the payment, are considered less risky and usually have lower fees compared to card-not-present transactions, such as online or phone payments.

- Merchant Category Code (MCC): The MCC assigned to a merchant by the payment card networks categorizes the type of business they operate. Different MCCs have different interchange fee rates, with some industries considered higher risk and subject to higher fees.

- Transaction Volume: The volume of transactions processed by a merchant can impact the interchange fees. Merchants with higher transaction volumes may be eligible for lower fees through volume-based pricing programs offered by payment processors.

- Processing Method: The method used to process payments can affect interchange fees. For example, using an EMV chip card reader for card-present transactions can qualify for lower fees compared to manually entering card details for card-not-present transactions.

Understanding the Different Types of Interchange Fees

Interchange fees can be categorized into different types based on various factors. It is essential for merchants to understand these types to accurately assess their payment processing costs and optimize their fee structure.

- Card Brand: Each payment card network, such as Visa, Mastercard, and American Express, has its own interchange fee structure. These fees can vary significantly between networks, making it crucial for merchants to evaluate the costs and benefits of accepting cards from each network.

- Card Type: Different types of cards, such as credit, debit, rewards, and corporate cards, have their own interchange fee rates. Credit cards typically have higher fees due to the additional benefits and rewards they offer to cardholders.

- Transaction Type: The nature of the transaction, whether it is a card-present or card-not-present transaction, affects the interchange fees. Card-present transactions, where the card is physically present during the payment, are considered less risky and usually have lower fees compared to card-not-present transactions, such as online or phone payments.

- Merchant Category Code (MCC): The MCC assigned to a merchant by the payment card networks categorizes the type of business they operate. Different MCCs have different interchange fee rates, with some industries considered higher risk and subject to higher fees.

Benefits and Drawbacks of Interchange Fees in Cloud Payment Processing

Interchange fees in cloud payment processing have both benefits and drawbacks for merchants. Understanding these pros and cons is crucial for merchants to make informed decisions about their payment processing strategies.

Benefits of Interchange Fees

- Infrastructure and Security: Interchange fees contribute to the development and maintenance of secure payment infrastructure, including fraud prevention measures, authorization systems, and payment networks. This ensures that merchants can accept card payments safely and securely.

- Convenience for Customers: Accepting card payments through cloud payment processing provides convenience to customers, allowing them to make purchases without the need for cash or physical payment terminals. Interchange fees enable the smooth functioning of this payment method, enhancing the overall customer experience.

- Global Acceptance: Payment card networks have a global presence, allowing merchants to accept payments from customers worldwide. Interchange fees facilitate this global acceptance, enabling businesses to expand their customer base and reach new markets.

Drawbacks of Interchange Fees

- Cost for Merchants: Interchange fees can be a significant cost for merchants, especially for businesses with high transaction volumes or low-profit margins. These fees can eat into a merchant’s profits and impact their overall financial performance.

- Lack of Transparency: Interchange fees are set by payment card networks and can be complex and opaque. Merchants may find it challenging to understand and predict their payment processing costs, making it difficult to budget and plan effectively.

- Limited Control: Merchants have limited control over interchange fees as they are set by payment card networks. This lack of control can make it challenging for merchants to negotiate or influence the fees they are charged.

How to Calculate Interchange Fees in Cloud Payment Processing

Calculating interchange fees in cloud payment processing can be a complex task due to the various factors and variables involved. However, understanding the basic principles and components of interchange fee calculation can help merchants estimate their payment processing costs more accurately.

The calculation of interchange fees typically involves the following components:

- Transaction Value: The total value of the transaction, including the purchase amount, taxes, and any additional fees or charges, is a key factor in determining interchange fees. The higher the transaction value, the higher the interchange fee.

- Card Type: Different types of cards, such as credit, debit, rewards, and corporate cards, have varying interchange fee rates. Merchants need to identify the card type used in the transaction to determine the applicable fee rate.

- Transaction Type: Whether the transaction is a card-present or card-not-present transaction affects the interchange fee. Card-present transactions, where the card is physically present during the payment, usually have lower fees compared to card-not-present transactions.

- Merchant Category Code (MCC): The MCC assigned to a merchant by the payment card networks categorizes the type of business they operate. Different MCCs have different interchange fee rates, with some industries considered higher risk and subject to higher fees.

- Payment Card Network: Each payment card network, such as Visa, Mastercard, and American Express, has its own interchange fee structure. Merchants need to identify the network associated with the card used in the transaction to determine the applicable fee rate.

Strategies to Minimize Interchange Fees in Cloud Payment Processing

While interchange fees are an inherent part of cloud payment processing, there are strategies that merchants can employ to minimize these fees and optimize their payment processing costs. Implementing these strategies can help merchants increase their profitability and improve their financial performance.

- Negotiate with Payment Processors: Merchants can negotiate with payment processors to secure lower interchange fees. Payment processors often have relationships with payment card networks and can leverage their volume to negotiate better rates for merchants.

- Optimize Payment Processing Infrastructure: Investing in advanced payment processing infrastructure, such as EMV chip card readers and tokenization technology, can help merchants qualify for lower interchange fees. These technologies enhance security and reduce the risk of fraud, making transactions less risky and eligible for lower fees.

- Monitor and Analyze Transaction Data: Merchants should regularly monitor and analyze their transaction data to identify patterns and trends that can help optimize interchange fees. By understanding the factors that influence fees, such as card type, transaction type, and MCC, merchants can make informed decisions to minimize costs.

- Implement Dynamic Currency Conversion (DCC): Dynamic Currency Conversion allows merchants to offer customers the option to pay in their home currency when making international transactions. By implementing DCC, merchants can earn additional revenue through currency conversion fees, offsetting some of the interchange fees.

- Explore Alternative Payment Methods: Merchants can explore alternative payment methods, such as digital wallets or cryptocurrency, that may have lower interchange fees compared to traditional card payments. However, it is essential to consider factors such as customer adoption and acceptance rates before implementing alternative payment methods.

Frequently Asked Questions

Q1. What are interchange fees?

Interchange fees are charges imposed by payment card networks on merchants for processing credit and debit card transactions. These fees are paid by the acquiring bank to the issuing bank and cover the costs associated with processing card transactions.

Q2. How do interchange fees work?

Interchange fees are a percentage of the transaction value and are set by payment card networks. They are paid by the acquiring bank to the issuing bank and contribute to the overall cost structure of accepting card payments.

Q3. What factors affect interchange fees?

Several factors influence interchange fees, including card type, transaction type, merchant category code, transaction volume, and processing method. These factors determine the risk and cost associated with processing card transactions.

Q4. What are the benefits of interchange fees?

Interchange fees contribute to the development and maintenance of secure payment infrastructure, provide convenience for customers, and enable global acceptance of card payments.

Q5. What are the drawbacks of interchange fees?

Interchange fees can be a significant cost for merchants, lack transparency, and limit merchant control over payment processing costs.

Conclusion

Interchange fees play a crucial role in cloud payment processing, determining the cost that merchants incur for accepting card payments. Understanding the intricacies of interchange fees is essential for merchants to make informed decisions about their payment processing strategies. By comprehending the factors that influence interchange fees, merchants can optimize their fee structure, minimize costs, and improve their financial performance.

While interchange fees are an inherent part of cloud payment processing, merchants can employ various strategies to minimize these fees and enhance their profitability. By negotiating with payment processors, optimizing payment processing infrastructure, monitoring transaction data, implementing dynamic currency conversion, and exploring alternative payment methods, merchants can navigate the complex fee structure and optimize their payment processing costs.