A Comprehensive Guide to Online Cloud Payments

In today’s fast-changing digital world, online cloud payments have become a game-changer for making transactions. This guide is here to help you understand and make the most of this exciting technology.

Imagine a safe and easy way to pay and do business online with no worries about security. That’s what online cloud payments offer! From keeping your information secure to processing payments instantly, we will explore all the important details. So, get ready to explore the world of online cloud payments and discover how it can make your life simpler and more convenient.

What are Online Cloud Payments?

Online cloud payments refer to a secure and efficient method of conducting financial transactions over the Internet using cloud computing technology. The cloud serves as a virtual platform that stores and processes data, allowing individuals and businesses to make payments, receive funds, and manage financial activities online. Instead of relying on physical servers or local infrastructure, cloud-based payment systems utilize remote servers, ensuring data accessibility and real-time processing from anywhere with an internet connection.

One of the key advantages of online cloud payments is their convenience. Users can easily access their accounts, monitor transactions, and initiate payments on various devices, such as smartphones, laptops, or tablets. Moreover, cloud payments often integrate with various payment gateways, credit cards, and e-wallets, providing a seamless and diverse payment experience.

Security is a top priority in online cloud payments. Advanced encryption and multi-factor authentication measures safeguard sensitive financial information, reducing the risk of fraud and unauthorized access. As the world increasingly embraces the digital realm, online cloud payments emerge as a vital and transformative force, simplifying financial interactions and driving the growth of e-commerce and digital business ecosystems.

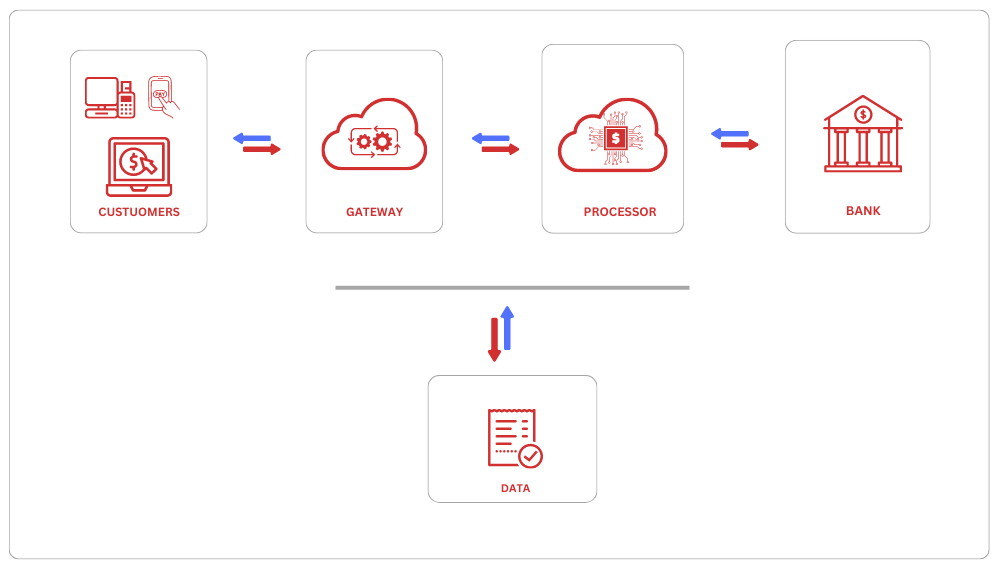

How Do Online Cloud Payments Work?

Online cloud payments rely on a sophisticated infrastructure and processes that seamlessly connect users, financial institutions, and merchants. Let’s delve into the key aspects of how this technology works:

1. Data Storage and Security

When a user signs up for an online cloud payment service, their payment, and personal information is securely stored in the cloud. This information may include credit card details, bank account numbers, and billing addresses. The cloud employs robust encryption and security protocols to protect this sensitive data from unauthorized access and cyber threats.

2. Payment Authorization

When a user initiates a payment, the online cloud payment system verifies their identity and checks for available funds or credit. This involves communication with the user’s financial institution, which may issue an authorization token confirming the payment’s validity.

3. Transaction Processing

Once the payment is authorized, the cloud payment system processes the transaction in real-time. This involves transferring funds from the user’s account to the merchant’s account. The cloud-based infrastructure ensures swift and efficient processing, reducing transaction times significantly.

4. Integration with Payment Gateways

Online cloud payment systems often integrate with various payment gateways, enabling seamless connectivity with different payment methods, such as credit cards, debit cards, and digital wallets. This integration expands the options available to users and facilitates a smooth payment experience.

5. Payment Confirmation

Upon successful completion of the transaction, both the user and the merchant receive payment confirmations. Users can also access their transaction history and financial records through the cloud platform for easy monitoring and reconciliation.

Overall, online cloud payments operate through a secure and interconnected system, leveraging cloud computing to handle data storage, transaction processing, and integration with payment gateways. This streamlined approach ensures a user-friendly and secure payment experience, fostering the growth of e-commerce and digital financial interactions.

Benefits of Online Cloud Payments

Online cloud payments offer numerous benefits for businesses, making them an increasingly popular choice for handling financial transactions. Here are some of the key advantages:

Enhanced Payment Convenience

Cloud payment solutions enable businesses to offer their customers a wide range of payment options, including credit cards, debit cards, digital wallets, and more. This flexibility enhances customer convenience, leading to higher customer satisfaction and increased sales.

Improved Efficiency

Cloud payment systems process transactions in real-time, reducing payment processing time significantly. This efficiency streamlines the payment collection process, allowing businesses to receive funds faster, improve cash flow, and better manage their finances.

Secure Transactions

Cloud payment platforms implement robust security measures, including encryption, tokenization, and multi-factor authentication, to protect sensitive financial data. This reduces the risk of data breaches and fraud, instilling confidence in customers and protecting the business’s reputation.

Accessible Anywhere, Anytime

Cloud-based payment systems can be accessed from any internet-connected device, making it convenient for businesses to manage payments on the go. This accessibility allows for remote management of financial activities, ideal for businesses with multiple locations or remote teams.

Scalability and Flexibility

Cloud payment solutions are highly scalable, adapting to the needs of growing businesses without requiring significant infrastructure investments. As transaction volumes increase, the cloud infrastructure seamlessly handles the workload, ensuring smooth payment processing.

Easy Integration

Many cloud payment platforms offer seamless integration with existing business systems, such as accounting software and customer relationship management (CRM) tools. This integration streamlines data management, reduces manual errors, and enhances overall business efficiency.

Data Insights and Reporting

Cloud payment systems often provide detailed analytics and reporting tools. Businesses can gain valuable insights into customer payment behaviors, sales trends, and other financial data, helping them make informed decisions and optimize their operations.

Global Reach

Online cloud payments enable businesses to expand their customer base globally. With multi-currency support and secure international transactions, businesses can reach customers worldwide, tapping into new markets and boosting revenue opportunities.

Why Businesses Should Consider Online Cloud Payments?

Image source

Businesses should seriously consider adopting online cloud payments due to the numerous benefits they offer. First and foremost, cloud payment solutions enhance customer convenience by providing multiple payment options, leading to higher customer satisfaction and increased sales. Moreover, the efficiency of real-time transaction processing accelerates payment collections, improving cash flow management.

Cloud payment platforms prioritize security, safeguarding sensitive financial data with robust encryption and authentication measures, instilling trust in customers, and protecting the business’s reputation. The accessibility of cloud payments from any internet-connected device allows for remote management, ideal for businesses with multiple locations or remote teams.

Additionally, the scalability and flexibility of cloud payment systems accommodate business growth without costly infrastructure investments. Easy integration with existing systems streamlines data management and reporting, enabling data-driven decision-making. Lastly, with global reach and multi-currency support, online cloud payments empower businesses to expand their customer base and seize international growth opportunities. Embracing online cloud payments is a strategic move that enhances operational efficiency, customer experiences, and overall competitiveness in the digital era.

Final Words

The adoption of online cloud payments represents a game-changing opportunity for businesses in today’s digital age. By leveraging cloud-based payment solutions, businesses can elevate their financial operations, providing customers with a seamless and secure payment experience.

The convenience, efficiency, and scalability offered by cloud payments empower businesses to streamline their payment processes, enhance customer satisfaction, and improve overall financial management. With robust security measures and easy integration, businesses can rest assured that their sensitive financial data is protected while gaining valuable insights to make informed decisions.

Moreover, the global reach of online cloud payments opens doors to new markets and revenue opportunities. Embracing this innovative technology is a strategic move that can position businesses at the forefront of modern commerce, fostering growth and ensuring long-term success in an ever-evolving business landscape.

Frequently Asked Questions (FAQs)

How do online cloud payments ensure security?

Cloud payment systems employ robust encryption, tokenization, and multi-factor authentication measures to protect sensitive financial data. These security features help prevent data breaches, unauthorized access, and fraud, ensuring a safe payment environment for users and businesses.

Can cloud payments be used for international transactions?

Yes, online cloud payments typically support multi-currency transactions, making them suitable for businesses with global customers or partners. With secure international payment processing, businesses can expand their reach and operate on a global scale.

What payment methods are supported by cloud payment systems?

Cloud payment platforms often integrate with various payment gateways, allowing support for a wide range of payment methods, including credit cards, debit cards, digital wallets, and bank transfers.

How do cloud payments improve business efficiency?

Cloud payments offer real-time transaction processing, reducing payment processing times and improving cash flow management. The accessibility from any internet-connected device enables remote payment management, making it convenient for businesses with multiple locations or remote teams.

Can online cloud payments be integrated with existing business systems?

Yes, many cloud payment solutions offer easy integration with existing business systems, such as accounting software and customer relationship management (CRM) tools. This integration streamlines data management and reporting, facilitating a more efficient overall business operation.